Social security tax calculator 2021

1982 22 11700 32400 556286. If you received repaid or had tax withheld from any non-social security equivalent benefit NSSEB portion of tier 1 tier 2 vested dual benefits or supplemental annuity benefits during.

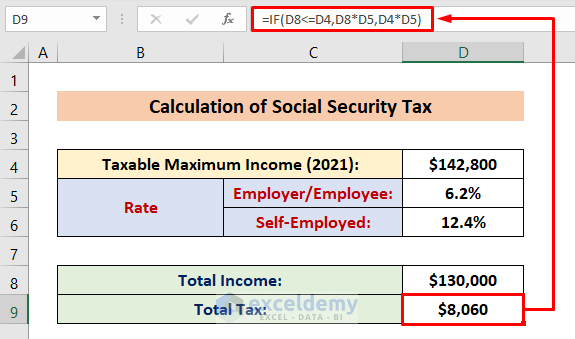

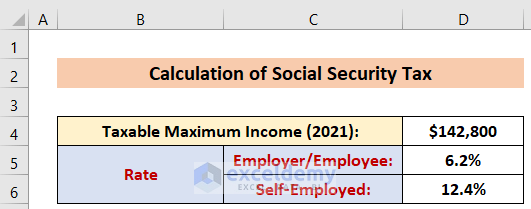

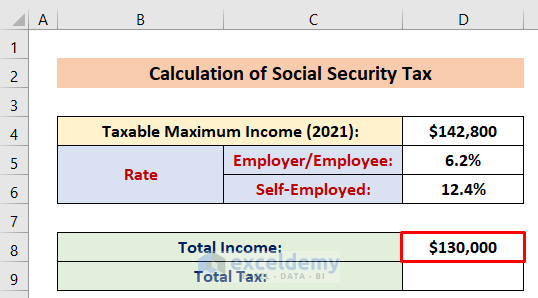

How To Calculate Social Security Tax In Excel Exceldemy

The Online Calculator below allows you to estimate your Social Security benefit.

. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. The tool has features specially tailored to the unique needs of retirees receiving. However if youre married and file separately youll likely have to pay taxes on your Social Security income.

For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad. The 2022 limit for joint filers is 32000. Instead it will estimate.

The estimate includes WEP reduction. Detailed Calculator Get the most precise estimate of your retirement disability and survivors benefits. About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future.

The AGI included in Column 1 is already reduced by the Social Security amount half of the benefit in Column 3 must be added back in. More than 44000 up to 85 percent of your benefits may be taxable. Social Security Benefits Tax Calculator Use the calculator below to know the amount if your social security benefit that you must include in the tax return as taxable.

Benefit estimates depend on your date of birth and on your earnings history. For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400. For each age we calculate.

The HI Medicare is rate is set at 145 and has no earnings. Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and. This means that regardless of how much money a person earns anyone who earns at least 147000 will pay a.

Earnings above this level of income are not subject to social security tax. When you purchase life and retirement. Multiply that by 12 to get 50328 in.

For security the Quick Calculator does not access your earnings record. To use the Online Calculator you need to enter all your earnings from your online Social Security. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

The maximum Social Security benefit changes each year. Must be downloaded and installed on your. For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021.

And so are we.

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Easiest 2021 Fica Tax Calculator

Social Security Wage Base Increases To 142 800 For 2021

Fresh Blank Business Check Template Word Payroll Template Template Printable Microsoft Word Templates

How To Get The Maximum Social Security Benefit Smartasset

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return Income Tax Return How To Find Out Business Tax

How To Calculate Social Security Tax In Excel Exceldemy

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Calculate Social Security Tax In Excel Exceldemy

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Resource Taxable Social Security Calculator

Pin On Spreadsheets

At What Age Is Social Security No Longer Taxed In The Us As Usa

Pin On Retirement

2022 Federal Payroll Tax Rates Abacus Payroll

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube